Useful Python and VBA for applications scripts to automate routine.

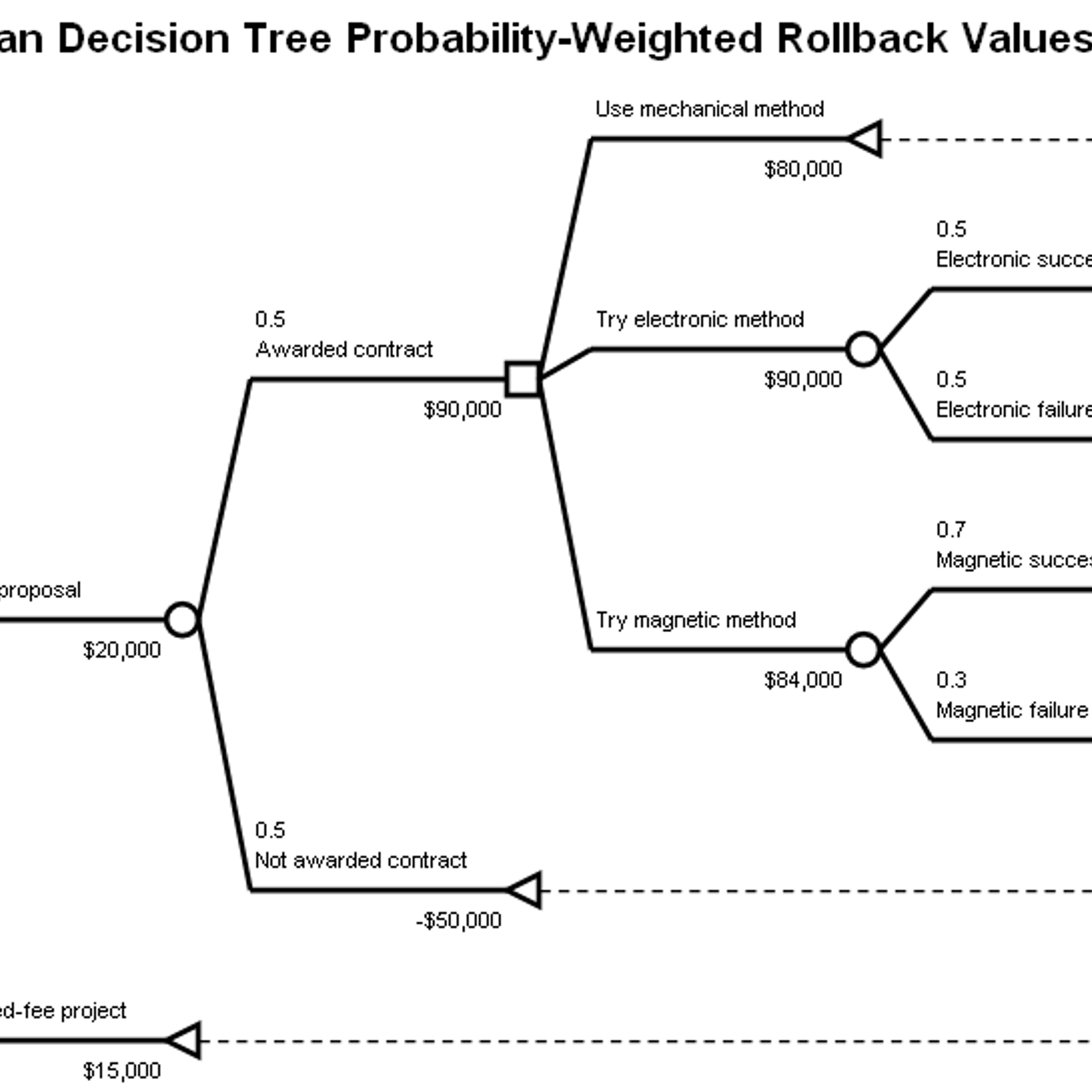

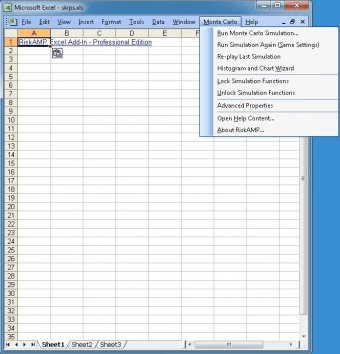

This Monte Carlo Simulation Formula is characterized by being evenly distributed on each side (median and mean is the same – and no skewness). The tails of the curve go on to infinity. So this may not be the ideal curve for house prices, where a few top end houses increase the average (mean) well above the median, or in instances where there. A Monte Carlo simulation calculates the same model many many times, and tries to generate useful information from the results. To run a Monte Carlo simulation, click the “Play” button next to the spreadsheet. (In Excel, use the “Run Simulation” button on the Monte Carlo toolbar). The RiskAMP Add-in includes a number of functions to. This list of Excel add-ins covers varying levels of sophistication and cost – from Risk Analyser at US$49 to others which cost thousands of dollars. This diversity should present enough options to find the most suitable product for particular needs. @RISK performs risk analysis using Monte Carlo simulation in an Excel environment. As we started doing more research into XLsim, we discovered that although the student version is supported on Mac and PC through Excel 2013, Dr. Savage has now developed a new approach to simulation, called SIPmath, which first, runs in native Excel without macros or add-ins, and second, will perform tens of thousands of trials before your.

How to check if a file exists in Excel-VBA

Today we will discuss different ways to check if a file exists in Excel-VBA.

Read more ...Network effects as value drivers for online digital companies

This research develops valuation methodology of digital companies which exploit network effects. The main asset of companies of this type is their user base. The business model design makes the user base of many of the companies to be directly observable and measurable by any user in the network (wholly or at least partially through sampling). This creates an opportunity for market participants to get an in-depth understanding of the state of the business of the company. This research starts with a brief recap of the key characteristics of networks and dynamic processes on them. After that the most common business model patterns of network companies are mapped and analyzed using business model canvas. Having obtained the mechanics of the business and the qualities of networks of users the DCF valuations are conducted. The baseline DCF simulations use top-down approaches for projecting cash-flows, growth and risks and the test case simulations use network science based approaches. The last part of the research is devoted to empirical testing of the influence of the network effects on company pricing using cluster analysis and multiple regression techniques. The findings of this research are of a value to valuation practitioners, standard setters and IR departments.

Read more ...Generating custom random distributions using Excel VBA

This custom function generates triangular distribution with a specified minimum, maximum and mean.

Read more ...Scraping all jobs you have applied for in LinkedIn using BeautifulSoup & Python

Even though LinkedIn tries to protect itself from web scrapers there are ways to extract information using Python. In this example we will gather info about all the positions we have applied to for as long as LinkedIn allows us to see (for me it is 2 years).

Read more ...Making a GIF animation using imageio - Python

Python code to merge images from a specified folder into a gif animation.

Read more ...

Manufacturing

[The DecisionTools Suite] has played a key role in increasing the quality of decision-making and helping project teams to think clearly, act decisively and feel confident.Read More

Oil & Gas

Risk analysis within Fluor has moved up to a different level because of @RISK.Read More

Software & Solutions for

Risk & Decision Analysis

Software & Solutions for

Risk & Decision Analysis

View All Products

View All Products Join a Distinguished Group

Request a Software DemoVirtual Training

Course 1 - Modelling with @RISK – June 01, 2021 9am-2pm (UK, Europe, Africa, Middle East, GMT+0 )

Register NowOffice For Mac Excel Add Ins Monte Carlo Key

Course 2 - Project Cost and Risk Register Modelling with @RISK – June 01, 2021 9am-2pm (UK, Europe, Africa, Middle East, GMT+0 )

Register NowLive Webinars

Register for one of our upcoming webinars by risk and decision analysis experts!

Intro to Forecasting Models using Regression with StatTools Wednesday, May 26th

Register NowSimulation with Historical Data in Monte Carlo Simulation Tuesday, June 8th

Register NowOn-Demand Webinars

Office For Mac Excel Add Ins Monte Carlo Online

See our library of On-Demand webinars, or watch one of our featured webinars below.

Office For Mac Excel Add Ins Monte Carlo 2017

What's New in @RISK 8

Watch Now

Emergency Preparedness Planning Before and During a Crisis

Watch NowDecisionTools Suite

Buy NowReady to get started?

Office For Mac Excel Add Ins Monte Carlo

Don't wait. You can purchase @RISK and the DecisionTools Suite right now with your credit card! Add the software to your secure cart and checkout to get your project started today.